The BLOG

This blog provides exclusive content for market researchers and marketing managers involved in Healthcare Marketing, prepared by APLUSA teams, and includes APLUSA important news updates.

Why is the Hemato-Oncology Market Complex for Market Researchers?

The hematology oncology market is one of the most rapidly developing, with over sixty oncology drugs having been approved by the FDA in the last five years. Advances in targeted therapies, biologics and drugs containing monoclonal antibodies (MABs) have proven to be extremely effective, adding significantly to the growth of the hematology oncology market. With this growth, the demand for primary market research in this rapidly developing therapeutic area is rising.

To find out more about the fast moving therapeutic area of hemato-oncology, download our eBook here.

Market researchers face four main challenges when conducting studies within hematology oncology:

1. Defining representative sample

2. Segmenting the market

3. The diversity of medical protocols for the same drugs used to treat different diseases

4. Lexical complexities

1. Defining a representative sample of physicians or patients in the hematology oncology market

Whether you are planning to conduct a study among patients or physicians, there are several factors that contribute to making a representative sample challenging to find. Market researchers face the reality that hematology oncology is not regarded as a stand-alone therapeutic area in every country. Physicians treating these patients may be hematologists or oncologists, or hemato-oncologists, or specialized in internal medicine. The lack of homogeneity in physician titles poses a problem for market researchers looking to recruit specialists in the field. Without experience, relevant screening criteria, and a well-connected international network, it would be difficult to recruit enough specialist physicians to conduct a representative study of the hematology oncology market.

Given the rate at which the oncology market is growing, the medical advances in hematology and the number of new drugs launching to market, the small population of specialist physicians are in high demand among market researchers. Their expertise is much sought after and as such it is essential for companies planning to conduct market research to work with agencies who have prior experience in the field.

Identifying patients for market research within this field is also challenging, as most of the related conditions are considered as rare diseases.

2. Segmenting the market for market research studies in hematology oncology

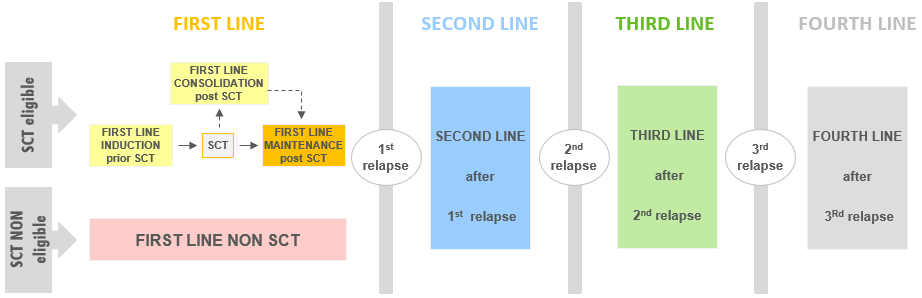

Defining lines of treatment within hematology oncology is more complex than in other medical areas. For example, a treatment could be prescribed first line as an induction treatment before stem cell transplant, or still first line as consolidation treatment after stem cell transplant, or first line again for a patient non-eligible for transplant. It is demanding and time-consuming to stratify patients in order to segment the market for market research purposes as patients can follow a multitude of regimens for the same disease, even if prescribed the same drugs. As patient treatment becomes increasingly personalized, this trend is predicted to increase in coming years. It is therefore critical for market researchers to have a broad overview and an understanding of all possible regimen options in order to identify the most relevant segment(s) of patients or physicians for a specific product.

3. Lexical complexities when conducting studies within the hematology oncology market

Lexical expertise and a comprehensive knowledge of the terminologies used within a therapeutic area are vital when conducting healthcare market research and notably within oncology. The language used by HCPs, buyers and patients within hematology oncology can vary significantly from one country or even one region to another. This is intensified by the presence of Key Opinion Leaders within the field who exert powerful influence on the language and practice of physicians based in a specific geographical area. Examples within oncology include Robert Z. Orlowski in the U.S. and Dr Raul Cordoba in Spain.

Conversations within global online hematology oncology communities (both among patients and physicians) are rising rapidly in frequency and detail. Through pairing social listening software with expert analysis market research companies have access to huge amounts of previously unseen data. But whether studying respondent’s answers to set questions, or analyzing the conversations of online communities, market researchers must ensure to include the terminology currently being used by the studied population. To conduct a fair study that offers balanced, global results within the hematology oncology market and to be able to interpret all data, market researchers must have a complete overview of the language that is used by all stakeholders in each region. One way in which to overcome this issue is to use clear explanations within surveys, as well as bespoke diagrams, such as this one regarding Multiple Myeloma:

4. Protocols

The repurposing or repositioning of drugs to treat different types of blood cancer occurs frequently within the hematology oncology market. The average novel oncology drug takes around ten years to develop and is associated with high failure rates. The much shorter timeframe for repurposing an already approved drug has been estimated to be approximately 6 years because initial drug development is not necessary. There are obvious benefits of repurposing drugs within the hematology oncology market; knowing potential side effects and knowing how best to administrate the drug, for example. It will be increasingly important for market researchers to be aware of the different protocols that may exist for the same drug when used in different regimens.

Sources:

You might also be interested in:

Who are the Digital Opinion Leaders in Hemato-Oncology?

5 Benefits of Syndicated Research in the Hematology-Oncology Market

Who Are The Key Onco-Hematology Market Stakeholders?